What Are Exchange Rates? A Complete Guide for Beginners

Exchange rates represent the price at which one currency can be exchanged for another. The pair of currencies used in these transactions is called a currency pair, essential for comparing values between two different currencies.

Understanding the Basics

You might have seen a notation like EUR/USD at a bank or online. Here, EUR is the base currency (Euro), and USD is the quote currency (US Dollar). If EUR/USD is 1.5043, 1 Euro can be exchanged for 1.5043 USD.

Monitoring currency pairs is essential for investors, travelers, and businesses that deal with international transactions.

Factors That Influence Currency Values

Exchange rates fluctuate due to several factors beyond simple supply and demand. Key drivers include:

- Economic Performance: Countries with growing economies attract foreign investment, increasing demand for their currency. Conversely, economic slowdowns may weaken currency value.

- Interest Rate Differences: Higher interest rates attract foreign capital, boosting the currency’s value. Lower rates often lead to depreciation.

- Trade Balance: Countries with trade surpluses usually see their currency strengthen, while deficits can lead to depreciation.

- Political Stability: Stable governments and policies encourage investment, while political uncertainty increases volatility.

External Link Example: Learn more about how interest rates affect currencies at Investopedia: Forex Basics.

The Relationship Between Exchange Rates and Prices

Exchange rates directly influence prices for consumers and businesses. If the currency weakens, imported goods become more expensive, driving domestic inflation. Strong currency benefits importers but can hurt export businesses.

Example: If Korean prices rise compared to Japan, American consumers may prefer Japanese goods, weakening the Korean Won (KRW) and raising the KRW/USD exchange rate.

Key Factors Determining Exchange Rates

- International Balance of Payments:

- Current account (goods & services) and capital account determine currency supply and demand. A deficit may cause the currency to weaken.

- Interest Rate Differences:

- Higher interest rates attract foreign capital, boosting currency value. Lower rates may lead to currency depreciation.

- Political Stability:

- Stable governments attract investors, increasing demand for the currency. Political instability can increase volatility.

Learn more about fundamental analysis and economic indicators for better trading strategies.

How Exchange Rates Affect Daily Life

Exchange rate fluctuations impact both businesses and consumers:

- Exporters: When the local currency weakens, export companies earn more foreign revenue when converted back to local currency.

- Importers: A weaker domestic currency increases the cost of imported goods, raising consumer prices.

- Travelers & Students Abroad: A stronger home currency reduces travel and study costs, while a weaker one increases expenses.

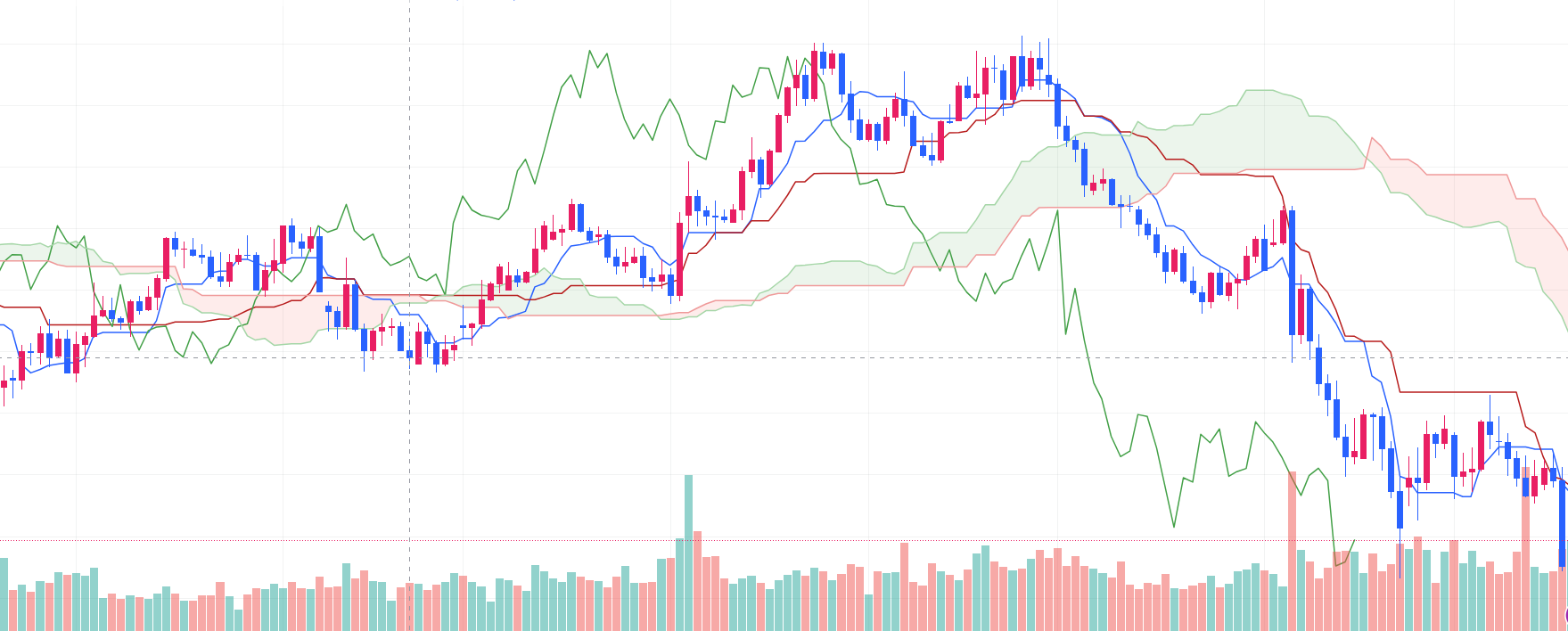

Monitoring Currency Trends

Investors can track FX market trends using tools like online trading platforms, economic calendars, and central bank announcements. Understanding these patterns helps in making informed trading decisions.

Check our fundamental analysis guide to see how economic indicators affect currency trends.

Exchange Rates and Investment

Exchange rates affect global investments:

- Forex Market: Traders profit by speculating on currency movements. For instance, buying USD when it is expected to strengthen.

- Stock Market: Currency fluctuations influence stock prices, especially for export-oriented companies.

- Bond Market: Foreign investors consider exchange rates when investing in bonds, affecting interest rate volatility.

For FX trading basics, see BabyPips: Forex Trading.

Importance of Currency Stability

Rapid exchange rate fluctuations can negatively impact an economy. Central banks intervene via monetary policy, including interest rate adjustments and market interventions, to maintain stability. Countries heavily reliant on trade, like South Korea, emphasize stable exchange rates for overall economic health.

Understanding the Broader Economy

Economic activity can be gauged by money flow:

- Active money flow boosts income and prices; slow flow signals a slowdown.

- Central banks raise rates to prevent overheating, reducing consumption and investment.

- Low interest rates encourage investment in stocks or financial products rather than bank deposits.

Conclusion

Exchange rates are more than numbers; they are a crucial element influencing economies, investments, and businesses. Investors should monitor currency fluctuations, central bank policies, and global economic trends to make informed decisions.

Check our guide on how economic indicators affect investing.