Why You Should Know Economic Indicators

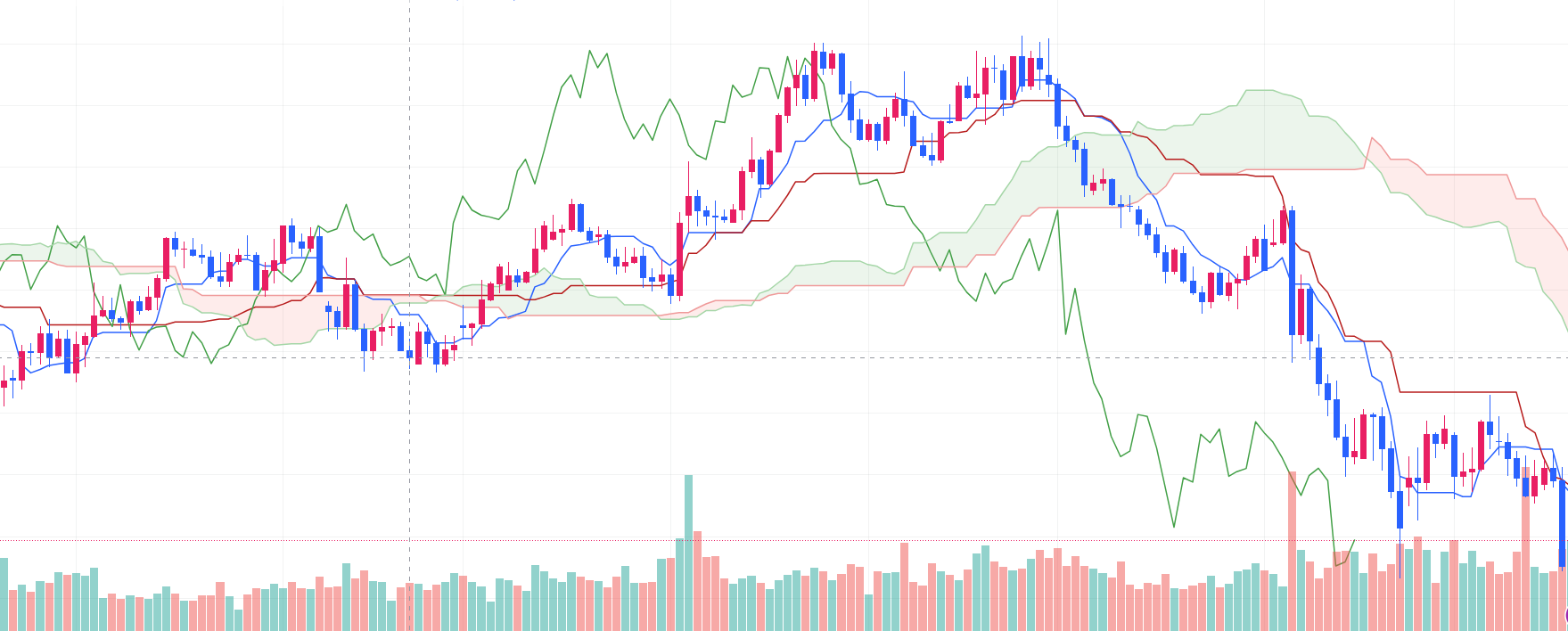

Investing isn’t just about recognizing company names or tracking stock price movements. Understanding the broader economic landscape and anticipating market trends is crucial for making informed decisions. At the core of this analysis are economic indicators.

Economic indicators are objective data points that reflect the current state of a country’s economy and are essential for building effective investment strategies. Almost every financial market—currencies, stocks, bonds, and more—reacts sensitively to shifts in these indicators.

A smart investor must understand the meaning of key economic indicators, their release schedules, and how they affect markets. For a full guide on trading strategies based on market data, see our Technical Analysis Guide.

1. Employment Statistics – Signs of Economic Slowdown or Recovery

Importance: ★★★★★

Release Date: First Friday of every month, 8:30 AM ET

Agency: Bureau of Labor Statistics (BLS)

Description:

Employment statistics are crucial for assessing labor market health. They measure the percentage of people in the workforce without jobs and serve as a key signal of economic growth or recession. Rising unemployment may indicate decreased consumer spending and economic slowdown, while falling unemployment can suggest recovery.

The Non-Farm Payrolls (NFP), which exclude agricultural jobs, are among the most closely watched metrics, affecting both the forex and stock markets significantly.

Another critical component is Average Hourly Earnings, which tracks wage growth. Rising wages can signal inflationary pressure, influencing central bank interest rate decisions.

Market Reaction:

Markets react immediately to the difference between expected and actual numbers. Major currency pairs can fluctuate over 100 pips within minutes after the report. Learn more about market reactions to NFP in Forex Trading Basics.

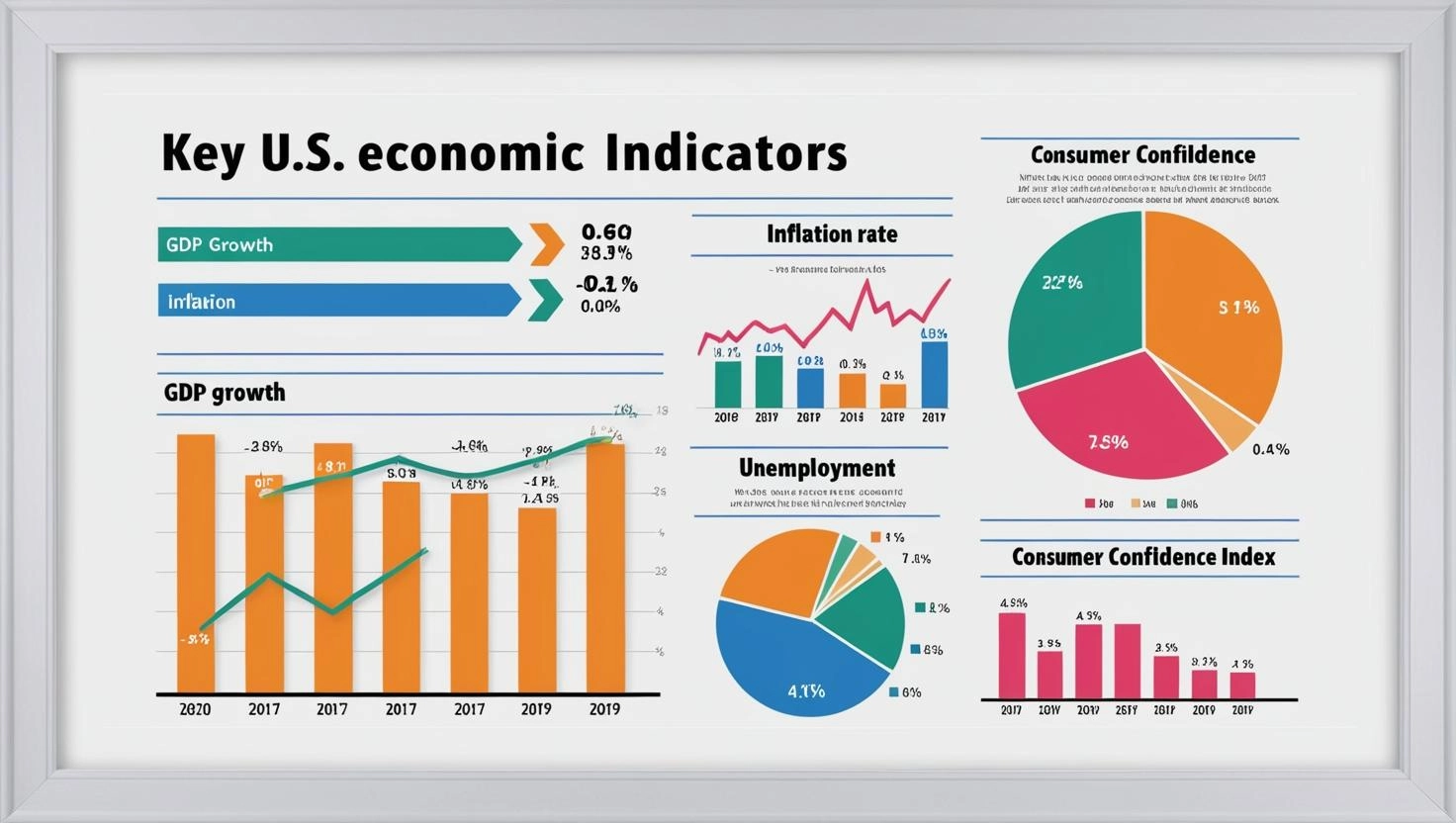

2. Unemployment Rate – Labor Market Health Indicator

Importance: ★★★★★

Release Date: First Friday of every month, 8:30 AM ET

Agency: Bureau of Labor Statistics (BLS)

Description:

The unemployment rate shows the proportion of job seekers in the labor market. Economists generally consider 4-5% as full employment. Rates below this suggest potential overheating and inflation, while higher rates indicate underutilized labor capacity.

Market Reaction:

Lower-than-expected unemployment signals economic growth, boosting stock markets, but may trigger interest rate hikes, affecting bonds negatively.

3. FOMC Statement – Key for Interest Rate Decisions and Economic Outlook

Importance: ★★★★★

Release Date: 8 times a year, after meetings, 2:00 PM ET

Agency: Federal Reserve

Description:

The FOMC statement provides guidance on interest rates, monetary policy, and economic conditions. Phrases like “tightening” or “easing” can trigger substantial market volatility.

Market Reaction:

Traders closely analyze every word. Hawkish tones can strengthen the USD, while dovish signals may weaken it. For strategies on trading around FOMC releases, visit Interest Rate Trading Guide.

4. Federal Funds Rate – Core Driver of Financial Markets

Importance: ★★★★★

Release Date: After FOMC meetings, 2:00 PM ET

Agency: Federal Reserve Board

Description:

The Federal Funds Rate influences short-term lending rates and the overall cost of credit. Rate hikes cool spending and investment, while cuts stimulate economic activity.

Market Reaction:

Unexpected rate changes can impact forex, equities, bonds, and real estate markets almost immediately.

5. Producer Price Index (PPI) – Leading Indicator of Inflation

Importance: ★★★★☆

Release Date: Mid-month, 8:30 AM ET

Agency: Bureau of Labor Statistics (BLS)

Description:

PPI measures price changes for goods and services at the producer level. Rising PPI can indicate inflation pressure ahead of the Consumer Price Index (CPI).

Market Reaction:

High PPI may drive expectations for interest rate hikes, strengthening the USD and increasing bond yields.

6. Consumer Price Index (CPI) – Detecting Inflation Risks

Importance: ★★★★★

Release Date: Mid-month, 8:30 AM ET

Agency: Department of Labor

Description:

CPI tracks changes in consumer prices and is crucial for inflation assessment. Core CPI, excluding volatile items like food and energy, offers a clearer long-term trend.

Market Reaction:

High CPI can trigger interest rate hikes, leading to USD strength, while low CPI may prompt easing policies.

7. GDP Growth Rate – The Economy’s Thermometer

Importance: ★★★★☆

Release Date: Quarterly, 8:30 AM ET

Agency: Bureau of Economic Analysis (BEA)

Description:

GDP measures total economic output. Real GDP growth, adjusted for inflation, provides insight into consumption, investment, government spending, and net exports.

Market Reaction:

Above-expected GDP growth can strengthen the currency but may pressure bond markets due to anticipated rate hikes.

8. Retail Sales – Measuring Consumer Market Vitality

Importance: ★★★☆☆

Release Date: Mid-month, 8:30 AM ET

Agency: U.S. Department of Commerce

Description:

Retail sales account for roughly 70% of economic activity, reflecting consumer spending trends. Core Retail Sales exclude auto sales to reduce volatility.

Market Reaction:

High sales data supports the USD and equities, while weak numbers may signal slowing growth.

9. Manufacturing PMI – Leading Indicator of Industrial Activity

Importance: ★★★☆☆

Release Date: Early month, 10:00 AM ET

Agency: Institute for Supply Management (ISM)

Description:

PMI above 50 indicates expansion; below 50 shows contraction. It measures production, new orders, employment, supplier deliveries, and inventories.

Market Reaction:

High PMI suggests economic strength, boosting the currency, while low PMI may dampen investor sentiment.

10. Initial Jobless Claims – Short-Term Labor Market Indicator

Importance: ★★★★☆

Release Date: Weekly, Thursday, 8:30 AM ET

Agency: Department of Labor

Description:

Weekly jobless claims measure the number of new unemployment benefit applicants, providing real-time labor market insights.

Market Reaction:

High claims suggest weakening employment, impacting stocks and forex negatively; low claims indicate recovery.

3 Practical Tips for Interpreting Economic Indicators

- Don’t rely on a single indicator: Combine multiple indicators for a comprehensive market view.

- Prioritize indicators based on economic phase: CPI and interest rates matter more during inflation, while GDP and unemployment are critical in downturns.

- Understand time-lag effects: Market reactions may not be immediate; flexible interpretation is required.

Start Using Economic Indicators in Your Investment Strategy

Economic indicators are an investor’s compass. Their true value lies in analyzing correlations between indicators rather than just numbers. Regularly monitoring these 10 key economic indicators can lead to more systematic and strategic investment decisions.