Fundamental Analysis: A Comprehensive Guide for Investors

Fundamental Analysis (FA) is a crucial tool for understanding fluctuations in asset values in financial markets. It involves analyzing economic, political, and social factors that affect an asset’s value, helping investors anticipate market trends based on economic conditions.

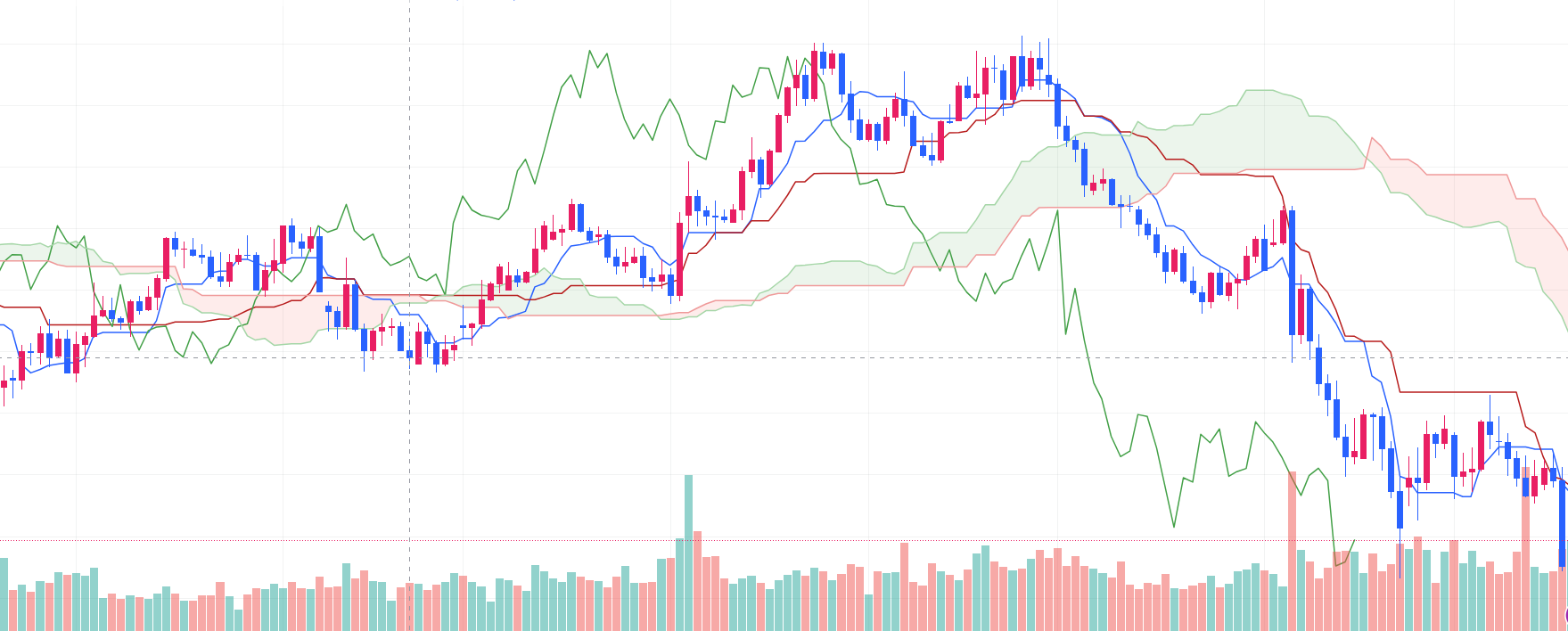

In financial markets, there are two main approaches: Fundamental Analysis and Technical Analysis. These methods complement each other. In forex, currency values are influenced by a country’s economic policies, political stability, and growth rates. In stock markets, factors such as corporate financial health, industry trends, management quality, and market share drive stock prices. Understanding these fundamentals is essential for predicting market movements.

Why Fundamental Analysis Matters

By using fundamental analysis, investors can evaluate a country’s economy or a company’s health and predict how these factors may affect market performance. For instance, major economic data from the U.S. often causes volatility in global currency and equity markets. Similarly, corporate earnings reports or major corporate events directly influence stock prices. Many traders align their strategies with key economic releases and earnings schedules.

What Are Economic Indicators?

Economic indicators are quantitative measures showing the economic state of a country over a specific period, often reported monthly, quarterly, or annually. They heavily influence exchange rates and stock prices.

Key Features of Economic Indicators:

- Regular Reporting: Most indicators are released monthly or quarterly. Example: the U.S. Non-Farm Payrolls (NFP) is announced every first Friday of the month.

- Market Impact: Unexpected results can cause rapid market fluctuations, altering currency and stock trends.

- High Volatility After Release: Markets often react strongly immediately after data releases. Strong employment figures, for example, can strengthen the U.S. dollar and boost U.S. equities.

Major Economic Indicators

- GDP (Gross Domestic Product): Measures a country’s growth rate. Higher growth positively impacts currency and stock markets.

- Employment Data:

- Non-Farm Payrolls (NFP): Tracks new jobs created outside agriculture, indicating economic activity.

- Unemployment Rate: Low unemployment signals a healthy economy, strengthening currency and corporate performance.

- Consumer Price Index (CPI): Tracks changes in consumer goods and service prices. Rising CPI may trigger central bank interest rate hikes, strengthening currency but increasing corporate borrowing costs.

- Retail Sales & Industrial Production: Reflect consumer spending and production activity, directly affecting growth, currency value, and corporate earnings.

Central Bank Policies and Market Impact

Central banks regulate money supply and interest rates, influencing both forex and stock markets.

- Interest Rate Decisions: Higher rates attract foreign capital, boosting currency value but potentially reducing stock prices due to higher borrowing costs.

- Major Central Banks: Federal Reserve (Fed), European Central Bank (ECB), Bank of Japan (BoJ).

- Quantitative Easing (QE) vs Tightening: QE increases liquidity, potentially lowering currency value but boosting stocks. Tightening reduces liquidity, supporting currency value but possibly suppressing equities.

- Statements & Meeting Minutes: Provide critical insights into future monetary policy, guiding investor decisions.

Political Factors in Forex and Stock Markets

Political stability plays a key role in market behavior. Political uncertainty or major events can increase volatility.

- Elections & Regime Changes: Can impact foreign investment, currency value, and stock performance.

- Geopolitical Conflicts: Wars, trade disputes, or sanctions directly affect markets, especially sectors like energy, defense, and international trade.

International Trade and Capital Flows

- Trade Balance:

- Surplus: Higher currency demand → currency appreciation

- Deficit: Lower currency demand → currency depreciation

- Export-Oriented Companies: Sensitive to trade conditions, impacting stock prices.

- Foreign Direct Investment (FDI): Inflows can strengthen currency and improve stock performance in receiving industries.

Corporate Fundamental Analysis in Stock Markets

Unlike forex, individual company fundamentals are critical in equity investing:

- Financial Statements: Revenue, net profit, operating margins, debt ratios indicate corporate health.

- Management Competence: CEO and executive strategies affect long-term growth.

- Industry Trends & Competition: Market growth, regulatory environment, and competitive intensity shape company value.

- Valuation Metrics: PER, PBR, dividend yield help identify under- or overvalued stocks.

Market Sentiment & Global Events

Investor sentiment influences market direction alongside fundamentals:

- Risk Appetite & Aversion: Stable economies drive investors to high-return assets; uncertainty pushes them to safe-haven assets like USD, JPY, CHF, government bonds, or defensive stocks.

- Natural Disasters & Emergencies: Can weaken currency and hurt corporate earnings; some sectors, like construction or insurance, may benefit from increased demand.

Risks and Characteristics of Trading Using Economic Indicators

Trading based on economic data is volatile. Rapid market reactions require accurate anticipation and risk management. News trading can exploit immediate responses, but quick decision-making and volatility control are essential.

Importance of Fundamental Analysis

Fundamental analysis provides insights into how economic, political, and corporate factors affect asset prices, guiding forex and stock market predictions. However, it cannot guarantee complete accuracy, as market psychology or technical factors sometimes dominate in the short term. Combining fundamental analysis with technical analysis is essential for balanced trading strategies.

Conclusion

Successful investing in forex and stock markets requires a blend of fundamental and technical analysis. Fundamental analysis helps understand macro trends and long-term direction, while technical analysis guides short-term trading decisions. In forex, economic indicators and central bank policies are key; in equities, corporate performance and industry trends are critical. Evaluating these factors collectively can lead to better investment outcomes.

For more information also check out “10 Key Economic Indicators You Must Know Before Investing” for further reading.