Forex Margin Trading, also known as FX Trading, is a financial product where investors buy and sell foreign currencies to earn profits from exchange rate fluctuations. By using margin (collateral), individual traders can leverage a small amount of capital to control larger positions. Unlike stocks, FX trading allows traders to profit in both rising and falling markets. While short selling exists in stock markets, it is not commonly used, making FX trading uniquely flexible.

Buying low and selling high is a basic principle of all trade, so losses from falling values are natural. However, FX trading allows potential profit regardless of whether the currency price rises or falls because it invests in the relative value between currencies.

The Forex market is formed not only by central banks but also by large market participants engaging in trade, capital flows, and investment. This makes it the most liquid market in the world.

Key Concepts in Forex Margin Trading

Currency Pair

FX trading always involves two currencies. Examples include:

- EUR/USD: Trading Euros against US Dollars

- USD/JPY: Trading US Dollars against Japanese Yen

The first currency (base currency) is what you are buying or selling, and the second currency (quote currency) is used to make the purchase.

Long and Short Positions

- Long (Buy): Expecting the price to rise, you buy the currency.

- Short (Sell): Expecting the price to fall, you sell the currency.

Leverage

FX trading is a prime example of leveraged trading. For instance, 10x leverage allows a 1 million KRW deposit to control a 10 million KRW position. Leverage amplifies potential profits but also increases the risk of losses.

Pros: Large trades with small capital, potential for high returns

Cons: Losses can exceed the initial investment

Spread

The spread is the difference between the bid and ask price, acting as the broker’s fee. Lower spreads mean lower trading costs.

Pip

A pip represents the smallest unit of price movement in currency pairs. For example, if EUR/USD moves from 1.1050 to 1.1051, it has increased by 1 pip.

Margin Call

If your account balance falls below the maintenance margin, brokers may request additional funds. Failure to meet this can result in forced liquidation, known as a margin call.

Advantages of Forex Margin Trading

- 24-Hour Trading: The Forex market is open 24/7, beginning in New Zealand and moving through Sydney, Tokyo, Hong Kong, Singapore, Europe, and finally New York. The most active hours overlap between the European and US sessions, particularly from 8 AM to 12 PM EST (10 PM–2 AM KST), when about 66% of trading occurs.

- High Liquidity: The OTC Forex market exceeds $6 trillion daily in volume, making it extremely liquid and resistant to market manipulation. BIS Quarterly Review

- Two-Way Profit Opportunities: FX trading allows both long and short positions, enabling profits in rising or falling markets.

- Leverage Usage: Leverage allows traders to maximize capital efficiency, but it must be used carefully.

Risks in Forex Margin Trading

- Leverage Risk: High leverage magnifies losses. For example, 100:1 leverage means a 1% adverse movement could wipe out your capital. Start with lower leverage (e.g., 10:1) and use stop-loss orders.

- Volatility Risk: Market prices can change rapidly due to economic data, political events, or natural disasters. Stay updated on news and monitor volatility indicators.

- Margin Call Risk: Occurs when your account balance drops below required margin, potentially causing forced liquidation and major losses. Maintain adequate collateral and trade with smaller positions.

- Fees and Spread: Spreads and additional broker fees are trading costs. Avoid frequent scalping if spreads are high; consider planned mid- to long-term strategies.

Getting Started with Forex Trading

- Choose a Broker: Open an account with a trusted broker or securities firm.

- Use a Demo Account: Practice trading without real money first.

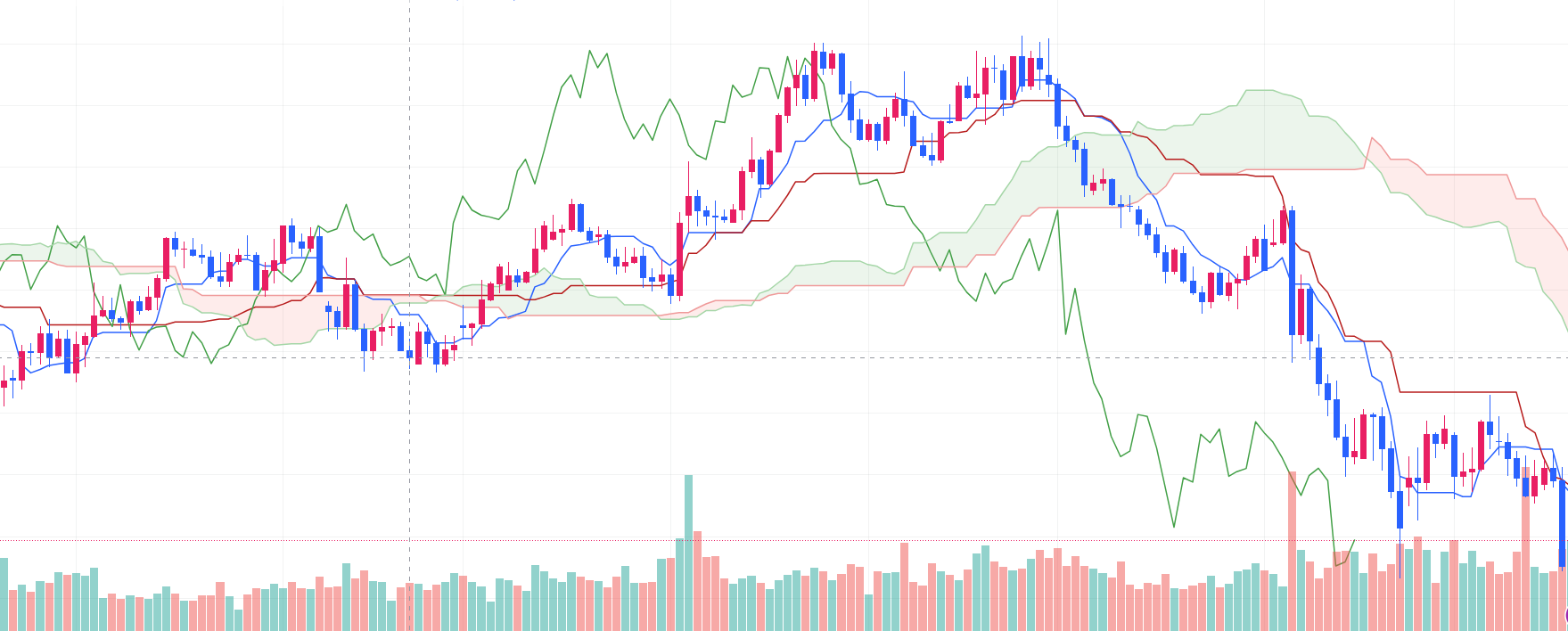

- Market Analysis: Learn technical and fundamental analysis to interpret charts and market trends.

- Risk Management: Set stop-loss orders and establish a capital management plan.

Conclusion

Forex Margin Trading can be an attractive investment tool for high returns, but it carries significant risk. Beginners must understand the concepts thoroughly, use leverage cautiously, and always apply strict risk management. Only trade with strategies that match your investment goals and risk tolerance.

For further learning, check out: